This story is the <Korean VC: Bluepoint Partners and the 3 Founders> episode 3.

3-line summary

Since the 'Chemical Substances Control Act' (Chemicals Act) was enacted in 2015, the demand for industrial safety products has increased, leading to growth in the related market.

The leadership in the area of assessing the risk of chemical leaks using chemicals has largely shifted to China. However, domestic companies have sufficient competitiveness in the chemical sensor field.

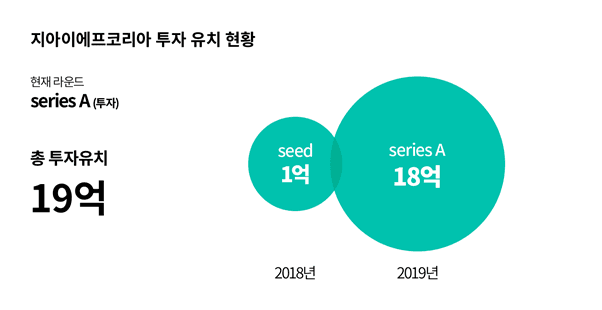

The maximum period for which government support can sustain is 3 years. To grow rapidly, partnerships must be established through investment.

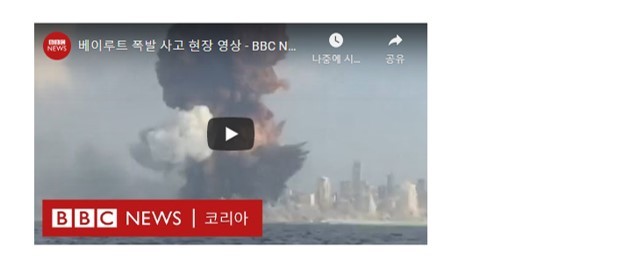

On August 4, 2020 (local time), a horrific accident occurred at the port in Beirut, the capital of Lebanon. Two large explosions resulted in

188 dead (as of August 31), and at least 6,500 were injured. The estimated property damage is said to amount to $15 billion (about 17 trillion won).

The cause of the explosion is believed to have been the explosion of ammonium nitrate that had been stored for a long time at the port. Apparently, there were as much as 2,750 tons of ammonium nitrate, which is a highly flammable substance. This is comparable in scale to the COEX Aquarium (3,000 tons).

Safety issues have a significant impact on lives and property, so no emphasis is too much. This is especially true for factories that handle toxic chemicals or flammable substances.

Toxic and flammable substances are often colorless and odorless. Ammonium nitrate is one such substance. Because of this, sensors are installed at worksites that handle these materials to prepare for emergencies. As they are generally heavier than air, they are placed near the floor or the bottom of walls.

However, once a flammable substance has leaked and the sensor has activated, it is already too late. If toxic substances have accumulated enough to be detected by the sensors at the bottom of a space,

that means leakage has been occurring for 2-3 hours. Furthermore, it is impossible to know where the leak is occurring.

Even if the site supervisor quickly recognizes the problem and issues an evacuation order, it takes time for it to reach even the lowest workers.

Work environments often contain high-temperature materials and welding sparks, which can lead to major accidents in an instant.

GIF Korea is a startup that has stepped in to solve these problems. They are developing a hazardous chemical leak management system. They install adhesive sensors that change color upon contact with hazardous substances at pipe joints to detect hazardous leaks early.

This sensor is not what we typically think of as an electronic sensor. It appears to be a thick rolled-up tape similar to box tape. This sensor is a polymer material sensor that does not react to harmless substances like water or dust, but only reacts to toxic chemicals. It is a patented product.

When the discoloration sensor changes, the linked alarm sensor and leak/gas detector activate, notifying the entire factory of the problem. GIF Korea is also building systems to detect and manage such safety issues early. By datafying areas and substances where toxic leaks frequently occur in factories, they are also utilizing this for safety consulting of the factories.

GIF Korea is currently expanding its business primarily in the southeastern region, such as Ulsan, where there are many chemical, gas, and steel companies, and starting to sell in overseas markets from this year. We spoke with CEO Ahn Hyun-soo about the current state of the factory safety market, global trends, and the startup ecosystem.

The expanding industrial safety market, how B2B companies grow

Q. Developing safety equipment, isn't commercialization and profitability difficult compared to technological advancements?

In the past, it is true that there was not much demand for safety and environmental products, making sales difficult. However, there have been many incidents in factories, and as public awareness of safety has increased, the situation has changed significantly. The perceptions of corporate employees have also changed a lot. In particular, the enactment of the 'Chemical Substances Control Act' (Chemicals Act) in 2015 was significant. If a supervisor notices an unexplained odor occurring in a factory, they cannot tell their subordinates to go check it out. Naturally, the demand for safety products has increased.

Q. Are companies actually increasing orders for safety equipment?

If an accident occurs in a factory, it poses a direct risk to the company, so the interests of safety management solution companies align well. However, it’s a problem that ordering companies tend to prefer established large companies. In the B2B market, unless a product comes from a company with a long history and large scale like Omron in Japan, it’s often not trusted. There aren't products that become successful through word of mouth like in B2C. If we say we want to supply GIF Korea's products, they always insist that we must test them first. Even if we pass through the operational staff, upper management often raises issues again.

Q. It sounds like a situation that initial companies cannot avoid. Is there a way to overcome this bias?

The product comes first. We have been generating revenue by hiring sales professionals from large companies and increasing the number of dealerships. We have also signed contracts with mid-sized companies like Wonik, which produces semiconductor materials. Our product is good, so Wonik is selling our product instead. For us, it raises brand awareness and increases sales, so we gladly accepted it. This is a buy-and-selling method in which we supply the product while Wonik handles the sales. Sales have significantly increased across the country. Since Wonik itself is a chemical company, the demand for safety is high. Our products have begun to spread to large companies too. Naturally, sales have increased accordingly.

Q. If we hand over the sales network, won't we lose control over pricing and decision-making? What if Wonik develops its own technology and takes over the market?

Even if sensor technology is opened up, I think it would be difficult to keep up with the manufacturing and management know-how. Even if the intermediate distributor has its own R&D center. In fact, we have tested many factories of Samsung Electronics, and the effectiveness has been proven. Compared to existing sensors that detect after an accident occurs, our technology builds systems by approaching the root problems of accidents while controlling various variables. Also, to confirm whether multiple alarms are truly genuine, data and know-how are needed.

Q. The differentiation points are not very clear. What distinguishes you from existing safety companies?

Existing companies attach sensors throughout the factory to detect internal toxic substances. However, the fact that they have detected something means that toxic substances have already accumulated in the factory. This method can only provide after-the-fact responses. In contrast, we attach sensors to points where leaks may occur, such as pipe joints, allowing for centralized management and control, which can quickly suppress accidents.

China, a strong competitor and a huge market

CEO Ahn Hyun-soo of GIF Korea said, “Korean companies still have enough competitiveness in the field of chemical sensors.” ⓒCentral Photo

Q. It seems that many safety management companies have emerged in Korea over the past few years. What are the market trends?

In the early days, most domestic companies were busy imitating imported products. The first generation is cable-type sensors. Domestic companies have excellent imitation abilities for new products from overseas, so they quickly caught up. In contrast, imported products were expensive and had low distribution margins. Therefore, they made way for Korean-made products. In this situation, with the recent enforcement of the Chemicals Act, many sensor development companies have emerged. For domestic companies, a situation has unfolded where they can explore overseas markets.

However, China is a problem. Chemical substance responsive sensors can be easily pursued with short-term research, and the global market leadership has largely shifted to China. The Chinese market is large, so it is advantageous for domestic companies to set up factories locally. It is also easier to attract investment.

Q. It seems necessary to have a product differentiation strategy at this point.

We are continuously creating new products. We have launched a reactive sensor that rapidly responds to fine gases at exposed areas. It is evaluated that our technology is 3-4 years ahead of China. If we expand this technology to liquefied natural gas (LNG) and liquefied petroleum gas (LPG), it can also be applied to shipbuilding. By installing sensors at each joint to trigger alarms in case of leaks. The market is not yet mature, but significantly advanced technology is emerging. The chemical sensor field has sufficient competitiveness even overseas.

Q. Graphene is called the 'dream nanomaterial' and how is it used for safety?

We utilize the technology to form a three-dimensional network structure of carbon materials. The development of heat dissipation pads that need heat transfer in all directions, like 5G mobile communication modules or electric vehicle batteries, is nearing completion. We have also secured technology for carbon nanocomposite materials to develop products that adsorb and eliminate sulfur compounds and bad odor particles generated from household odors or harmful gases. We have extended our business model into the realm of living spaces.

Q. The new products seem to be able to target overseas markets as well?

We are planning to enter China. After the Tianjin explosion in 2018, many factories in the local area realized the importance of safety issues. At that time, many said it felt like a war had broken out. Initially, we are marketing to domestic firms with factories in China. We are targeting companies in all regions of China and Taiwan through local large distribution companies and will start delivery from September. If we pass on-site tests, we expect significant sales in China and Taiwan.

Government support lasts for 3 years; investment is necessary for growth

Q. It is said that it is difficult to be a tech company in Korea; didn't you find it hard to receive government support?

I think the time when startups can receive the most support is within 3 years. During this period, the government is trying to provide various directions to help. Initially, it was difficult to set these directions, so I focused on filling in as much information as possible in the documents to help them understand. It can be called a plan filled with nothing but passion. After experiencing failure once or twice and seeking consulting, I got advice from a friend who is involved in government-supported projects and crafted my business plan based on the key points they called for, resulting in consistently good outcomes and significant assistance to the business.

Q. GIF Korea has grown significantly with government assistance, but there must be many companies that haven't.

I have heard that these days, many entrepreneurs are applying for government projects to build their careers. They establish companies and receive around 50 million to 100 million won in government support while gaining experience to apply for jobs in large companies. It’s a troubling issue if one has to decide whether to distribute a limited budget fairly or concentrate it on well-performing companies. Personally, I believe selection and focus are necessary. We need to nurture companies that have the will and determination to succeed. If a startup succeeds, many companies grow with it. If a startup continues to receive grants from a founder who lacks ambition, it could lead to complacency. Such companies can no longer be called startups.

Q. Don't VCs actively seek out promising startups like GIF Korea?

I met many excellent VC representatives while seeking investments. They evaluated business potential with affection and provided mentoring. However, there were also individuals who made me question whether they could genuinely assess startups from such a perspective.

Funding is an important process for startups. The ideal relationship is one where both startups and VCs benefit mutually. If a founder lacks experience in business and technology, I believe they should meet many experts like VCs to learn and share information. In this respect, I believe GIF Korea has a good relationship with Bluepoint.

Q. How did you meet Bluepoint Partners?

It was when we reached the finals of the Industrial Bank of Korea competition in 2017. That’s when I first met Director Hwang Hee-cheol and decided to receive consulting from Bluepoint. As a manufacturing company and an early-stage business, our business presentation materials were quite rough in various aspects. By addressing the unknown and lacking points, we ultimately won the Grand Prize at the Industrial Bank of Korea competition. Additionally, we secured investments as well.

Q. What did you want to learn from Bluepoint?

I wanted to objectively confirm whether the path I was taking was correct. Therefore, I mainly discussed how far I should expand my business and how much investment I should obtain. I received assistance in both technology and management aspects of the business. It was an opportunity to share new values.